Rulefinder

Shareholding Disclosure

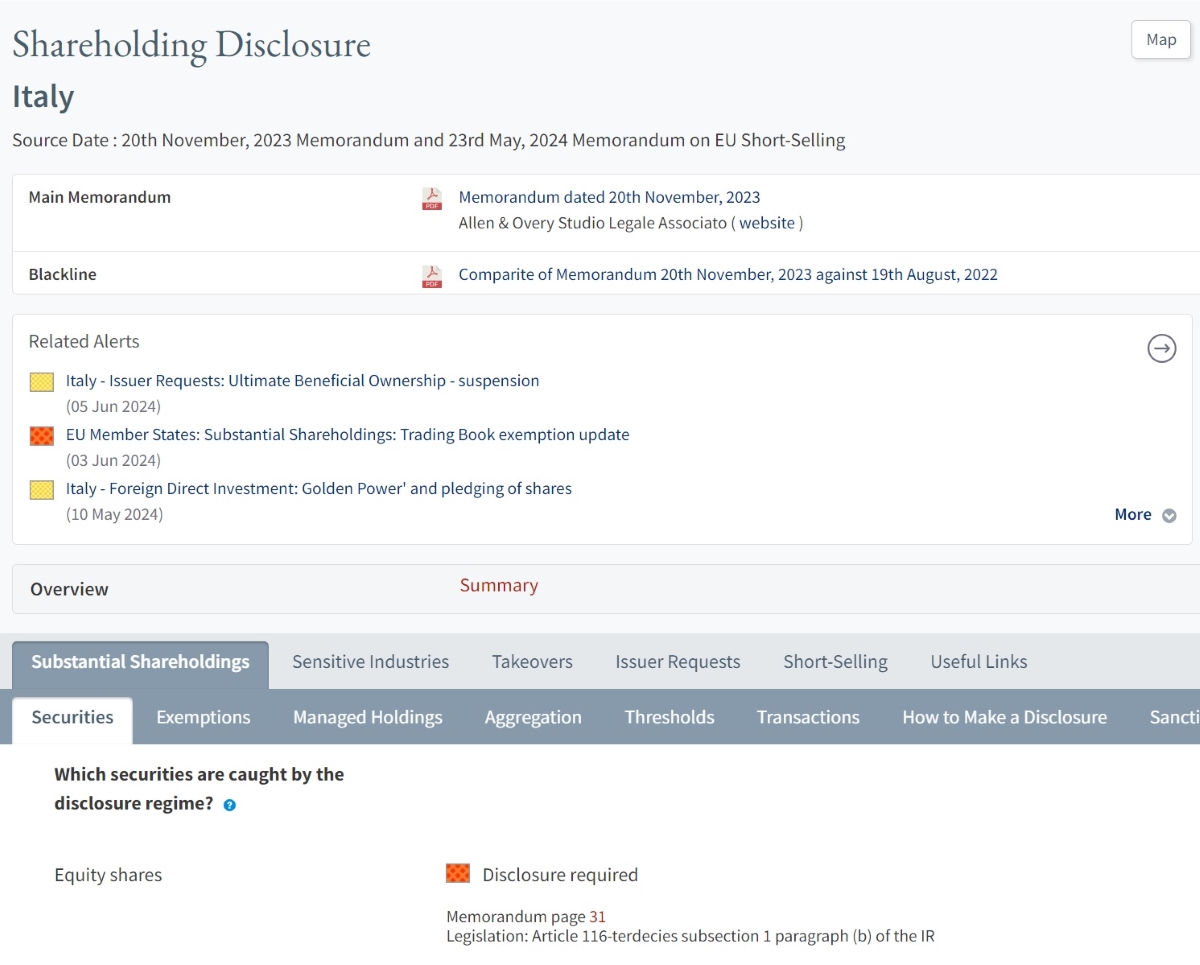

Comprehensive analysis of shareholding disclosure thresholds and reporting obligations

How it works

Rulefinder Shareholding Disclosure is an online legal service designed to help organisations navigate shareholding disclosure rules across the globe. It's simple to access, easy to navigate and maintained daily by a senior legal team.

Used by more than 450 institutions globally, this product:

- Covers major shareholdings, short selling, sensitive industries, foreign direct investment, takeovers and issuer requests across 100+ jurisdictions

- Keeps you up-to-date with daily horizon scanning alerts and a dedicated tracker of global shareholding disclosure developments

- Includes option to integrate with leading partners

- Is available as an annual subscription. No tie-ins, no fuss

Who it's for

Our trusted content is used by a wide range of financial institutions, including banks, asset managers, pension funds and hedge funds.

How it helps

We work with leading counsel across the global to negotiate a detailed memoranda of law which we provide alongside practical colour-coded extracts.

The detail is there for those who need it, and is available in summary format for those who don't.

Well-designed and intelligent product

US Investment Management Firm

Product features

Jurisdictions covered

We provide consistent and comparable analysis across 100+ jurisdictions with Mongolia coming soon.

Austria, Belgium, Bulgaria, Croatia, Cyprus, Czech Republic, Denmark, Estonia, Finland, France, Georgia, Germany, Gibraltar, Greece, Guernsey, Hungary, Iceland, Ireland, Isle of Man, Italy, Jersey, Latvia, Liechtenstein, Lithuania, Luxembourg, Malta, Monaco, Netherlands, Norway, Poland, Portugal, Romania, Russian Federation, Serbia, Slovakia, Slovenia, Spain, Sweden, Switzerland, Turkey, Ukraine and United Kingdom

Bahrain, Botswana, Egypt, Ghana, Israel, Jordan, Kenya, Kuwait, Lebanon, Mauritius, Morocco, Namibia, Nigeria, Oman, Qatar, Saudi Arabia, South Africa, Tunisia, Uganda, United Arab Emirates, Zambia and Zimbabwe

Argentina, Bahamas, Bermuda, Brazil, British Virgin Islands, Canada (Ontario), Cayman Islands, Chile, Colombia, Costa Rica, Curaçao, Ecuador, Jamaica, Mexico, Panama, Peru, Puerto Rico, United States, Uruguay and Venezuela

Australia, Bangladesh, China, Hong Kong SAR, India, Indonesia, Japan, Kazakhstan, Malaysia, Marshall Islands, New Zealand, Pakistan, Papua New Guinea, Philippines, Singapore, South Korea, Sri Lanka, Taiwan, Thailand and Vietnam

View sample content

Experienced senior lawyers

Rulefinder Shareholding Disclosure is managed by a team of senior regulatory lawyers, many of whom have been with aosphere for over a decade. They have had careers at leading global law firms and as in-house legal counsel at financial institutions. The team also has expertise of regulatory reporting in top-tier financial institutions.

Now specialists in comparative legal analysis, they are highly experienced in interpreting and applying complex shareholding disclosure laws and regulations across global jurisdictions in this business-critical area of compliance.

This expertise, combined with a strong collaborative ethos, ensures the quality, consistency and practical value of our content.

Main topics covered

- Beneficial Ownership / Substantial Shareholdings

- Short Selling

- Sensitive Industry limits / Foreign Direct Investment (FDI) restrictions

- Enhanced Takeover Reporting Thresholds

- Complex Portfolio and Group Aggregation Scenarios analysed

- Complex asset classes analysed including CFDs and other derivatives, futures, stock lending, convertibles /exchangeables, warrants, ETFs and Indices and Baskets

- Application capacity based exemptions (e.g. nominee, custodian, stock borrower, stock lender or collateral taker)

- US 13D and 13G reporting and filing

- US 13f-2 short selling rules

- US Alternative Uptick Rules for short selling

- EU Transparency Directive (2004/109/EC)

- EU Amending Transparency Directive (2013/50/EU)

- EU Regulation No 236/2012 - net short position reporting for shares, sovereign debt and sovereign CDS

- Hong Kong: Part XV of the Securities and Futures Ordinance

- Singapore “Securities and Futures Act” notifications

- UK Irish and French Takeover Panel disclosures

- Issuer-initiated disclosures, (e.g. section 793 UK Companies Act, section 1062 Irish Companies Act and section 329 of the Securities and Futures Ordinance in Hong Kong)

Rules Engines

Increasingly, subscribers want to utilise our market leading legal analysis in a rules engine format where they can reduce their manual reporting activities. We are the leaders in working with the RegTech industry to combine shareholding disclosure legal analysis with tech. We licence our content to a range of third party RegTech providers.