Rulefinder

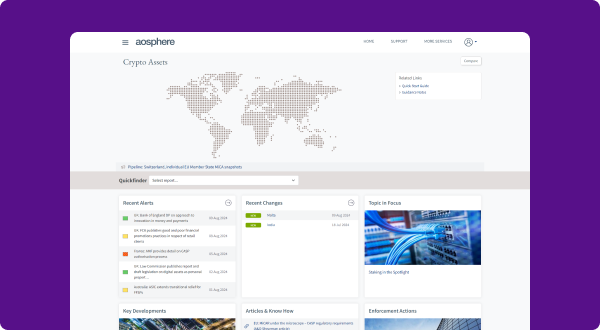

Crypto Assets

High quality analysis of crypto asset regulation at your fingertips

How it works

It can be difficult to make sense of the noise surrounding crypto regulation. And it doesn't help that the policy, legal and regulatory landscape is developing (and changing) at pace. Or that there is a lack of consensus over basic terminology - what some jurisdictions refer to as 'crypto assets', others will call 'virtual' or 'digital' assets.

That's where Rulefinder Crypto Assets comes in. We've given crypto the 'aosphere' treatment, setting up a dedicated team of senior lawyers to wade through hordes of rules and guidance relating to crypto/virtual/digital assets in liaison with leading local counsel, determine what really matters, and simplify it.

Who it's for

Rulefinder Crypto Assets is ideal for:

- Start-up firms entering the crypto space and trying to decide what their global coverage will look like

- Larger or existing institutions trying to understand and assess how crypto asset activities may align with their traditional finance activities

- More broadly, firms and industry intermediaries or service providers interested in the direction of travel for digital asset regulation

How it helps

We don't just share knowhow or state the law, we provide up-to-date, practical analysis with substance. Golden nuggets of legal information.

Oh, and we'll also alert you to what’s coming next in terms of actual or proposed, new or amended crypto legislation, rules or guidance.

Navigating the crypto asset regulatory landscape just got easier.

Product features

Jurisdictions covered

Rulefinder Crypto Assets provides consistent and comparable analysis of crypto asset regulation in a range of key jurisdictions. We currently cover the below with more to come.

EU Member States, Austria, Czech Republic, Estonia, France, Germany, Ireland, Italy, Jersey, Lithuania, Luxembourg, Malta, Netherlands, Poland, Portugal, Spain, Switzerland and United Kingdom

Abu Dhabi Global Market, Dubai International Financial Centre, South Africa and United Arab Emirates (covering the position under each of the UAE Central Bank, UAE Securities and Commodities Authority and Dubai Virtual Assets Regulatory Authority regimes)

Argentina, Bermuda, Brazil, British Virgin Islands, Cayman Islands, Mexico and the United States

Australia, Hong Kong SAR, India and Singapore

Product team

Experienced senior lawyers

Rulefinder Crypto Assets is managed by a team of senior financial services lawyers, many of whom have been with aosphere for nearly a decade. They began their careers at top-tier law firms before branching into roles such as in-house counsel at financial institutions, knowledge/professional support lawyers as senior practitioners at a regulator. Many have trained and practised internationally.

As experts in comparative legal analysis, they evaluate and distil the key rules and regulations, offering insights into fast-moving areas like crypto regulation.

Their wide-ranging experience and collaborative approach underpin the quality, clarity and practical value of our content.

Jenny Ljunghammar

Co-Head, FinReg Products

Penny Blair

Co-Head, FinReg Products

Sharon Gowdy

Counsel - FinReg Products

Emily Hillson

Specialist FinReg Lawyer

John Dyson

Specialist FinReg Lawyer

Kirsty Gibson

Specialist FinReg Lawyer

Kate Pang

Specialist FinReg Lawyer

Sarah-Jane Elsner

Specialist FinReg Lawyer

Serena McMullen

Specialist FinReg Lawyer

Luca Di Lorenzi

Specialist FinReg Lawyer

What do we mean by crypto assets?

The term crypto asset varies between jurisdictions. At a high level, it broadly covers a digital representation of a value or a right which may be transferred and stored electronically using distributed ledger technology or similar technology. Different jurisdictions use different reference terms, for example, ‘virtual asset’ or ‘digital asset’.

We’ve collaborated with local counsel in each of the jurisdictions to understand how crypto, virtual, or digital assets are treated from a regulatory perspective and the types of assets or related services that might be in or out of scope. These include, for example, security tokens, payment tokens, cryptocurrencies, utility tokens, stablecoins and non-fungible tokens.

Main topics covered

- Government/regulatory attitudes towards crypto assets, key expected developments, and how crypto assets are defined (where applicable)

- Whether and how crypto assets and their related services fall within existing financial services regulatory frameworks

- Analysis of legal and regulatory restrictions for marketing/selling, potential exemptions or exclusions, and any additional considerations

- Practical steps for obtaining licences and authorisations, local presence obligations, and guidance on timings and costs

- Applicable anti-money laundering/countering the financing of terrorism (AML/CFT) measures, including information on obtaining registrations and licences

- Additional considerations for retail investors

- For EU Member States, how crypto assets and related services are regulated under the Markets in Crypto-Assets Regulation (MiCA), as well as the steps being taken by individual EU Member States to align domestic legislation with MiCA and with respect to matters left to their discretion